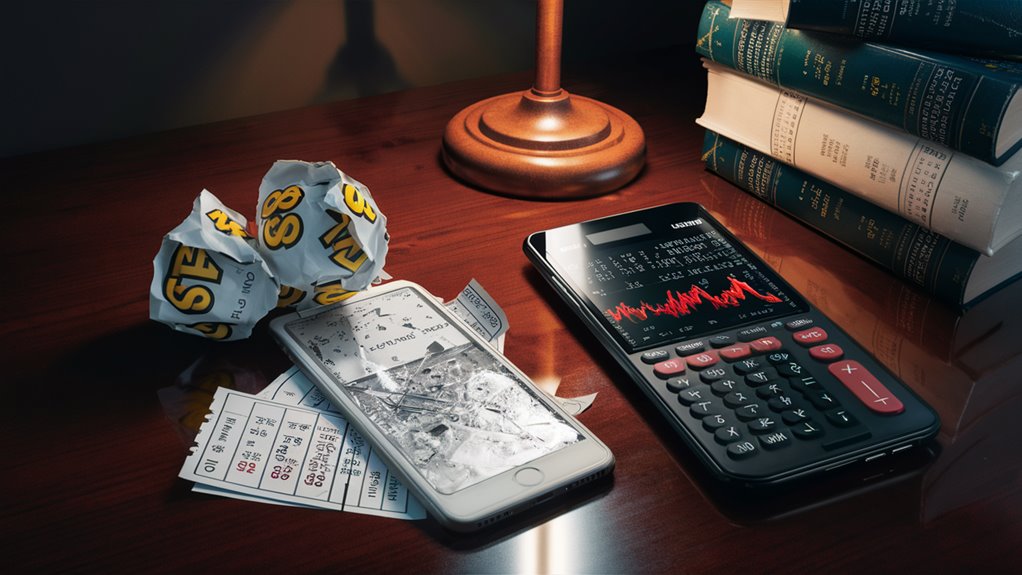

Turning Crypto Trading from Chance to Stats

How Stats Change Trading

To trade crypto well, switch from guessing to using data-based stats ways. By using set math plans, traders can build ways to win that do better than just feeling it.

Main Math Ideas for Winning

How Big to Bet and Keeping Risk Check

- Keep bets small, 1-2% per move

- Use the Kelly Rule to share money right

- 이 자료 참고하기

- Set stop losses based on the big price moves

Looking at Charts

- Use many chart signs to start

- Only take bets if you could win double what you might lose

- Keep an eye on how you do

Stats Leading in Crypto Markets

Study shows that stats ways win against just feeling the market by 40% over long times. This lead comes from:

- Making choices based on odds

- Always using good plans

- Not letting feelings rule

- Proving trades with math

Better Results with Data

Good crypto trading needs:

- Taking good notes on trades

- Analyzing how you did

- Testing your plans

- Figuring out risk and return

By focusing on these stats, traders can keep a steady lead in crypto markets based on clear odds not guess The Connection Between

Odds Vs Feelings in Trading

Odds vs Feelings in Trading: A Data-Based Way

The Fight Between Knowing and Feeling

Winning in trading is all about the big fight between making choices on stats and what you feel in crypto markets.

Looking at price moves, market cycles, and risk-and-return with stats often gets better results than just going with gut feelings.

Common Traps in Trading on Feel

The Big Three Bad Moves

Bad trading acts usually show up in three main ways:

- Selling in a rush when prices drop

- Buying too much when prices jump

- Betting too much feeling too sure

Each of these moves goes against clear stats thinking and good risk checks, leading to big money losses.

Building a Trading Plan on Stats

Math Wins Over Market Feel

A strong trading way needs:

- Using numbers to check the market

- Looking at past data to see patterns

- Figuring out the stats edge for choosing trades

Things You Need For Success

To really win with stats, you will need to:

- Set clear times to get in and out

- Figure out how big to bet based on what you have

- Change stop-losses based on how wild the market is

- See if the risk is worth the possible win

Keeping Math in Your Trading

Change how you trade by:

- Using a system of rules that keeps feelings out

- Setting exact trade rules before going into the market

- Using math to decide how to spread your money

- Keeping track of what works with stats

This planned way makes sure choices stay on stats not just what you feel, leading to more steady and winning trading.

Knowing Risk-Return Math Ratios

Knowing Risk-Reward Ratios in Trading

The Base of Stats in Trading

Risk-reward ratios are key in stats-based trading, giving exact math ways to figure out possible wins vs losses for any trade.

If a trader bets $100 to maybe make $300, the risk-reward ratio goes to 1:3, linking each risk unit to three reward units.

Finding Expected Value (EV)

Expected value mixes risk-reward ratios with the chance of winning to find the stats edge.

For example, a 1:3 risk-reward setup with 40% win chance leads to the following EV count:

- In a win: 0.4 × $300 = $120

- If lost: 0.6 × $100 = $60

- Net expected value: $120 – $60 = $60 (positive EV)

Putting in Solid Trading Rules

Setting hard risk-reward minimums (like 1:2) keeps feelings out of trading.

Writing down trades and tracking lots of moves confirms the real edge in trading.

Success is about always using these math plans, not just some of the time.

Need-to-Haves for Trading Wins:

- Good risk checks

- How-big-to-bet counts

- Stats checks on trades

- Keeping track of how you do

- Making your win rate better

Checking Stats on Market Moves

Stats Look at Market Moves: A Full Guide

Knowing Stats Market Checks

Stats look at market moves means a set check of past price changes through clear number signs and chart tools.

Rather than just going with gut, winning traders use data-based ways to find good trade chances through regression check, how things work together scores, and how spread out it is counts.

Main Stats Ideas in Trading

Mean going back is a key stats rule in market checks, especially in crypto trading.

By counting averages over different times and looking at how much prices go off, traders can find big probable turn points with more sureness.

More Stats Tools and Signs

Chance shapes are big in guessing market moves.

Top traders look at how peaky and how lopsided numbers are to see if price moves follow usual shapes or show wild acts.

Chart tools like How Strong is it Sign (RSI) and Price Move Bands give stats ways to find too bought and too sold market times.

Testing and Checking Patterns

Good trade plans need hard stats checks through full testing.

Key do-well signs include win rates, gain parts, and Sharp counts, which help tell apart true pattern signs and just market chance moves.

This data way cuts down on feeling-based choices and supports set trading acts based on proven stats ways.

Set You Bet Sizes with Data

Set Your Bet Sizes with Data for Top Trading

Set Bet Sizes Based on Big Price Moves

Through full stats checks, bet size plans set trade shares based on three key things: huge price moves, what you own, and risk rules.

The base is using a price move-based bet size model that changes bet sizes opposite to how wild the market gets. This way cuts how much you’re in when it’s wild, and more when it’s calm.

Putting in Tech and Keeping Risk Check

The Average True Move (ATM) sign is key for counting right bet sizes, checking price moves over 14-day times.

Top traders use Kelly Rule plans, mostly using safe parts between 0.25 to 0.5 of the planned best bet size. This stats way stops over-betting even when the market seems good.

Changing Risks and Bet Sizes

Risk rules keep tight checks with per-move risk capped at 1% of all you have and total risk at 5%.

These rules change based on how you did from the last 100 moves, including win rates and risk-reward scores.

During low times, the system cuts bet sizes by 50% until things look up past the top mark, keeping out feeling moves and stopping chasing losses.

Math Plan for Bet Sizes

Main formulas and counts mix move counts, owning checks, and risk rules to find the best bet sizes:

- Bet Size = (What You Own × Risk Part) ÷ (ATM × ATM Times)

- Expected Value = (Win Rate × Usual Win) – (Lose Rate × Usual Lose)

- Kelly Part = (Edge × Odds) ÷ Risk

This set way brings steady, stats-right trade moves while keeping exact risk check across different market times.

Kelly Rule for Crypto Putting Money

The Kelly Rule for Crypto Money Putting

Knowing Bet Sizes in Crypto Trade

The Kelly Rule gives a math way to set the best crypto money bet sizes based on stats edge and win chance.

This strong formula helps set the best share of the money: K = W – [(1-W)/R], where W is the win chance and R is the win-lose rate.

Real Use in Crypto Markets

Bet Size Example

Think of a crypto trade way with a 60% win chance and a 2:1 reward-to-risk rate. The Kelly Rule count shows a 20% money risk share.

But, using a part Kelly way of 50% or 25% gives more room against chance counting errors.

Putting in Risk Management

The big win of the Kelly Rule in crypto trading is in its help to:

- Stop too much money out there

- Make grow chances bigger

- Give math-right bet sizes

- Mix risk and reward well

Better Strategy Use

Good use needs:

- Detailed trade notes and docs

- Regular rechecks of chance counts

- Data checks of real trade results

- Keep making win rate counts better

The formula works best with right chance checks in crypto markets.

Keeping full trade logs and changing counts based on what really happens rather than just plans makes sure the best bet sizes for long money grow.

Stats Signs and When to Start

Stats Signs and When to Jump Into Crypto Trade

Main Chart Tools for Crypto Deal

Chart signs give crypto traders clear start signs based on stats patterns in market acts.

Three key signs for finding the best time to jump in: the How Strong is it Sign (RSI), Moving Lines Together or Apart (MACD), and Price Move Bands.

Knowing RSI and MACD Hints

The RSI sign gives strong too-sold hints when numbers fall below 30, showing chances to buy in crypto markets.

MACD moves give more yes when the MACD line goes over the hint line while being down – a big sign of starting to go up.

Price Move Bands and Big Price Moves

Price Move Bands are key for checking how wild the market is and seeing likely price turns.

Traders should watch times when price moves hit the low band while RSI shows too-sold states, making a high-chance start setup.

Using Many Signs Together

Using a mix of signs cuts wrong hints in crypto trading.

Rather than just going with one hint, winning traders wait for yes from many chart tools.

The mix of RSI too-sold states, MACD moves, and band spots makes a strong start plan.

How Big to Bet and Keeping Risk Check

Turning chart hints into real moves needs right bet sizing based on math ways like the Kelly Rule.

This set way turns hints from just signs into full chance tools, letting traders make data-based moves while keeping tight risk checks.